Cash Converters has posted solid results with strong performance across its core Australian business, while announcing the exit of loss making UK and car leasing businesses

Cash Converters (CCV) has posted solid 1H16 results with strong performance across all channels of its core Australian business. A six month strategic review has been completed with CCV to exit its underperforming and loss making UK and Carboodle divisions. While such action will have net costs of up to $15m before tax, (including non cash items) this is overall credit positive given losses from these divisions will be eliminated going forward and capital and management attention can be redirected to its successful Australian operation.

Further to the good result, CCV’s recent announcement of replacement financing and banking facilities has removed a key risk to the business. CCV’s fixed rate bonds are offering attractive value at an indicative 7.77% yield to maturity in September 2018. The bonds are available to wholesale and retail client in minimum $10k denominations.

Summary results:

| $m | 1H16 | 1H15 |

|

Sales revenue

|

198.64

|

187.75

|

|

EBITDA

|

36.54

|

2.85

|

|

EBITDA (underlying)

|

37.33

|

32.40

|

|

NPAT

|

15.89

|

-5.50

|

|

Cost/income

|

52.4%

|

66.2%

|

|

EBITDA (underlying)/interest

|

8.76x

|

6.98x

|

|

Debt/total capital

|

30.7%

|

32.7%

|

Source: Company reports

Key points:

- Revenue grew 5.8% to $198.6m driven by an increase in retail sales of $11.4m, pawn interest of $1.4m and financial services commission of $1.5m

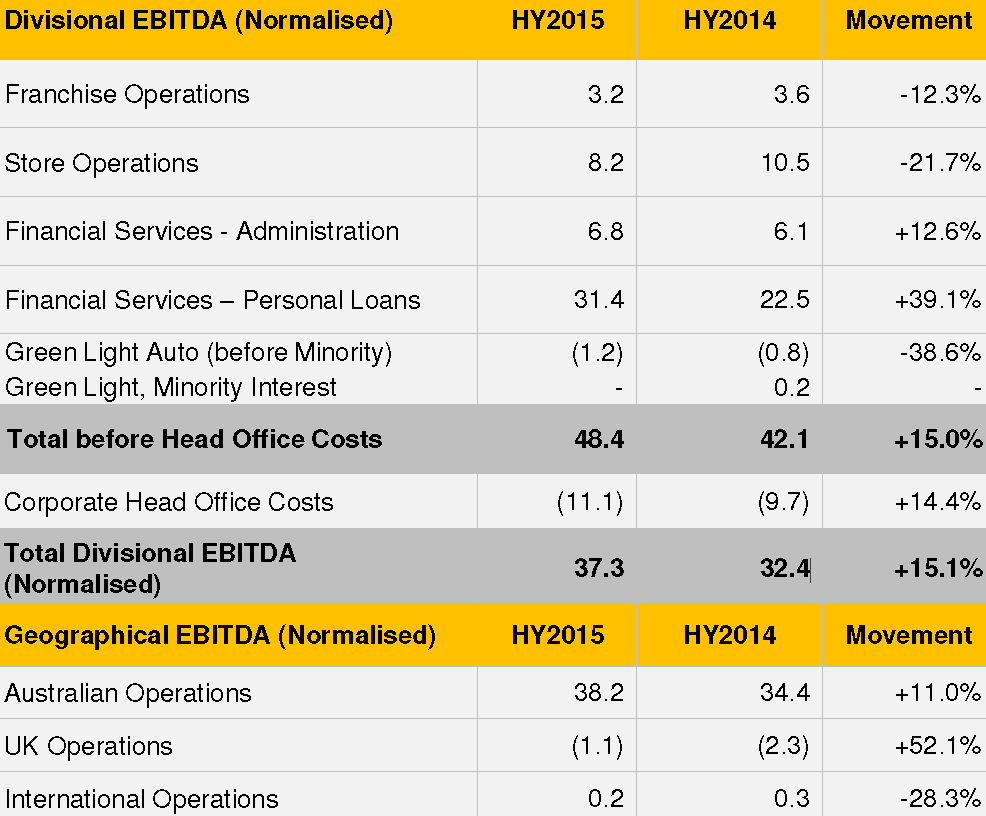

- Normalised EBITDA was up 15.1% to $37.3m

- Gearing improved to 30.7% (1H15: 32.7%) and interest coverage increased to a strong 8.76x (1H15: 6.98x)

- Outlook: The only guidance that was given was that the Australian business produced EBITDA of $38.3m and CCV ‘expects to see further growth’ over 2H16, meaning an Aussie EBITDA of $76.6m plus

Geographical and divisional discussion

Source: Company report

- On a geographic basis normalised EBITDA was up 11.0% to $38.3m in Australia while the UK improved to an EBITDA loss of $1.1m compared with a loss of $2.3m in 1H15.

- The UK business incurred an impairment charge of £1.1m ($2.2m) during 1H16 as conditions remained difficult especially in regard to the corporate store network which performed behind plan and incurred further losses

- The UK personal loan book was £8.7m ($16.9m) at 1H16 and produced an EBITDA of £284k compared to a loss of £1.6m for 1H15

Source: Company report

- Australia performed well across all channels. Corporate stores EBITDA was up 2.9% to $10.5m and the Australian cash advance product’s EBITDA was up 15.7% to $6.2m

- The personal loan book was steady at $115.8m. Online personal loans were up 42.5% to $44.6m and online cash advances were up 62.1% to $8.2m.

- The bad debt percentage of cumulative principal written off (less bad debts recovered) to cumulative principal advanced for the Australian business increased to 7.1% (1H15: 6.3%), however, total net bad debts written off in 1H16 was $21.1m compared to $30.3m in 1H15

Strategic change following six month review

Australia: Carboodle will cease operations with the current lease book wound down. At 1H16, 850 active leases were in place with forward contracted lease payments of $23.8m. 1H16 EBITDA was a loss of $1.14m (1H15: loss of $1.52m).

The business will look to transition to a new secured motor lending business, Green Light Auto Finance. This will operate as a low overhead, capital ‘light’ business supported by a funding platform from a third party. CCV expects this business to break even within 12 months.

CCV will also broaden its current lending product range with the introduction of medium amount credit contract (MACC) loans. These are government regulated and with loan periods of up to two years for amounts up to $5,000. CCV believes there is a gap in the market which could provide strong growth for the group.

United Kingdom: CCV will return to its original role as a master franchisor. It will therefore sell its corporate stores to franchisees within its network and will also divest the UK personal loan book. This will eliminate losses from this division. CCV estimates it can return to stable profit in the UK from FY17.

Key points:

- The intended restructure is credit positive and will remove underperforming and loss making businesses

- Capital and management attention can be redirected and focused to markets and businesses with current competitive advantages and high return potential

- The cost of this restructure is not expected to be greater than $35m before tax, including non cash items. Offsetting this is an expected $20-30m from the sale of UK stores and its circa $17m UK loan book

Government review of the small amount credit contract

The government review of the small amount credit contract (SACC) laws continues. An interim report was released in December 2015 and review recommendations are due by the end of February 2016, although we note there has already been some delay.

The committee has already stated that the industry is a legitimate part of the economy. Hence, any changes will allow for the industry to be profitable. The interim report had some suggestions which could affect industry viability. We assume therefore, that following further industry consultation these suggestions will not become recommendations.

Our continued expectation is that there will be limited changes to SACC regulations.